Late Q4 is one of the most volatile periods in digital advertising. Costs surge, competition intensifies, and user behavior shifts week by week. Planning your budget without understanding these changes can lead to wasted spend or missed revenue. A strong approach requires balancing high-impact spending windows with strategic restraint.

Why Late Q4 Behaves Differently

Advertising demand increases dramatically during the final 6–7 weeks of the year. Businesses across industries compete for the same audiences, pushing CPMs and CPCs to their annual peak.

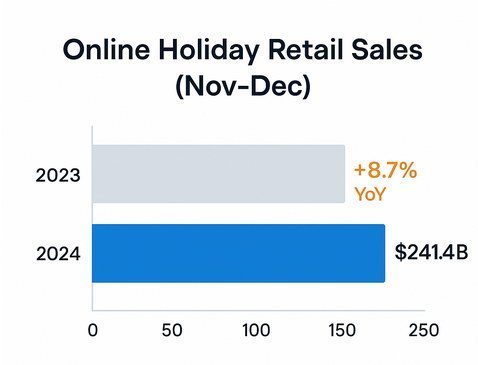

Online holiday sales reached $241.4 billion in Nov-Dec 2024 — an 8.7% increase on the prior year

Key seasonal patterns include:

-

In many markets, CPMs can rise 20–50 percent during the core holiday window.

-

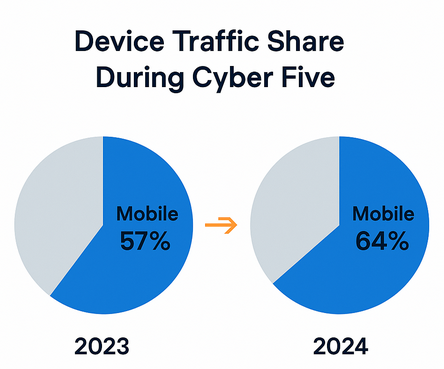

Mobile purchase activity grows significantly, with more than 55 percent of holiday ecommerce orders coming from mobile.

-

Over 70 percent of shoppers research products digitally before purchasing, often days or weeks earlier than expected.

Understanding these shifts ensures you’re not just spending more, but spending smarter.

When to Increase Spend

Mobile devices accounted for 64% of visits during Cyber Five 2024, up from 57% the year before

Mid-November to Cyber Week

This is typically the highest-return period of Q4. Shoppers are actively buying, and motivation is high. Although costs increase, conversions rise enough to maintain efficient results.

Use this window to:

-

Promote strongest offers

-

Retarget high-intent visitors collected earlier in Q4

-

Leverage warm audiences to maximize ROAS

Studies consistently show that conversion rates can jump 25–40 percent in this period, making heavier spending worthwhile.

December 1–10: Capitalize on Post-Cyber Momentum

While CPMs remain elevated, the audience is still warm. Many consumers who browsed during Cyber Week return to complete purchases. Smaller promos or reminders often perform well.

This phase benefits from budget that supports:

-

Retargeting campaigns

-

Quick-purchase product categories

-

Limited-time delivery guarantees

When to Hold Back

Mid-December: Shipping Cutoff Slowdown

As shipping deadlines pass, purchase urgency briefly declines. CPMs do not fall at the same rate, making performance less predictable.

During this period:

-

Scale back prospecting spend

-

Shift focus to low-cost audience nurturing

-

Prepare last-minute gift or digital-product messaging

December 24–26: The Distraction Window

These dates are historically low-performing because shoppers are occupied with holidays rather than browsing or buying.

A reduced budget protects your ROAS during a time of low intent.

When to Re-Increase Budget

December 27–31: The Year-End Surge

Many advertisers underestimate this window. Yet after-holiday shoppers return with:

-

Gift cards to use

-

Interest in post-holiday discounts

-

Time off, increasing browsing activity

Some retailers see up to a 30 percent jump in engagement compared to mid-December. With fewer advertisers aggressively competing, costs may soften slightly, improving return.

Building a Smart Late-Q4 Budget Framework

1. Allocate Heavily Around Known Peaks

Focus 40–55 percent of late-Q4 budget between Cyber Week and December 10.

2. Maintain a Controlled Middle Period

Assign 15–20 percent for mid-December nurturing and retargeting.

3. Reinforce the Year-End Window

Reserve 25–35 percent for December 27–31.

4. Use Data From Early Q4 to Guide Decisions

Metrics such as add-to-carts, email signups, and product page views earlier in the quarter help predict where to invest most strongly.